The smart Trick of Three Things To Avoid When You File Bankruptcy That No One is Discussing

If you can’t find a method of getting from personal debt in the subsequent 5 years – and also have diligently researched remedies – then bankruptcy may possibly advantage you.

Your creditors can also mark any accounts discharged in bankruptcy as “A part of bankruptcy.” This data can remain in your credit history file for 7 yrs.

Figuring out crimson flags and realizing the best way to suitable inaccuracies as part of your credit rating report might help keep your credit history rating in great shape. This is what you have to know.

On the other hand, if you qualify for Chapter 7 but have been filing Chapter 13 to stop a house loan foreclosure or payback An excellent tax credit card debt, you probably could avoid any judgment liens towards your home. Our knowledgeable Chapter 13 bankruptcy lawyers will thoroughly evaluate your circumstance this means you understand your choices.

Financial debt Reduction: What it is actually, How it really works, FAQs Financial debt reduction will involve the reorganization of the borrower's debts to create them easier to repay. Credit card debt aid can come in a variety of kinds. It also can give creditors an opportunity to recoup no less than a portion of what they are owed.

It's essential to go to a credit rating counseling system administered by an accredited credit counseling company inside one hundred eighty times in advance of pop over to this site filing for bankruptcy. The credit rating counselor can make clear bankruptcy effects you could experience and enable you to navigate your choices.

For anyone who is wanting to know if bankruptcy could assist you, Speak to us these days to get a no cost analysis. Let us find out if our attorneys will view publisher site help you secure a brighter financial upcoming.

Absolutely everyone’s situation is different. Before you begin the whole process of filing for bankruptcy, take into account the variety of debts you might have, how much you owe, and what you want your fiscal situation additional info to appear like in a single calendar year, five years, and a decade.

A bankruptcy substantially influences equally your credit history rating and credit history report. Bankruptcies seem in the public data part within your credit report for as much as ten years from your date of discharge.

Whether or not you go it try this site by itself or with legal enable, you’ll want to complete a credit rating counseling course before filing. The system should be from the govt-approved organization and accomplished in one hundred eighty times prior to filing.

Bankruptcy can be a make any difference of public report, so potential businesses or customers, spouse and children and neighbors can entry this info. On top of that, anyone who shares responsibility in your debt will be impacted when you file.

On the other hand, it’s achievable to acquire an Original consultation with a lawyer for no demand. You might get worthwhile facts from an hour-lengthy converse, including whether you’re visit this site right here a fantastic candidate for bankruptcy.

Contemplate Consolidating or Settling Debts Personal debt consolidation, through which several superior-desire debts are paid off with just one decrease-fascination loan, is usually outlined for a tool to avoid bankruptcy.

You must also file and pay back applicable taxes during the bankruptcy process or submit an application for an extension. Your situation could be dismissed when you fail to file your return or pay back taxes in the course of the bankruptcy method.

Jaleel White Then & Now!

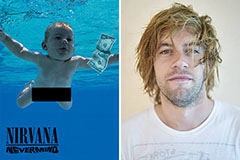

Jaleel White Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Jenna Jameson Then & Now!

Jenna Jameson Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!